All Categories

Featured

Table of Contents

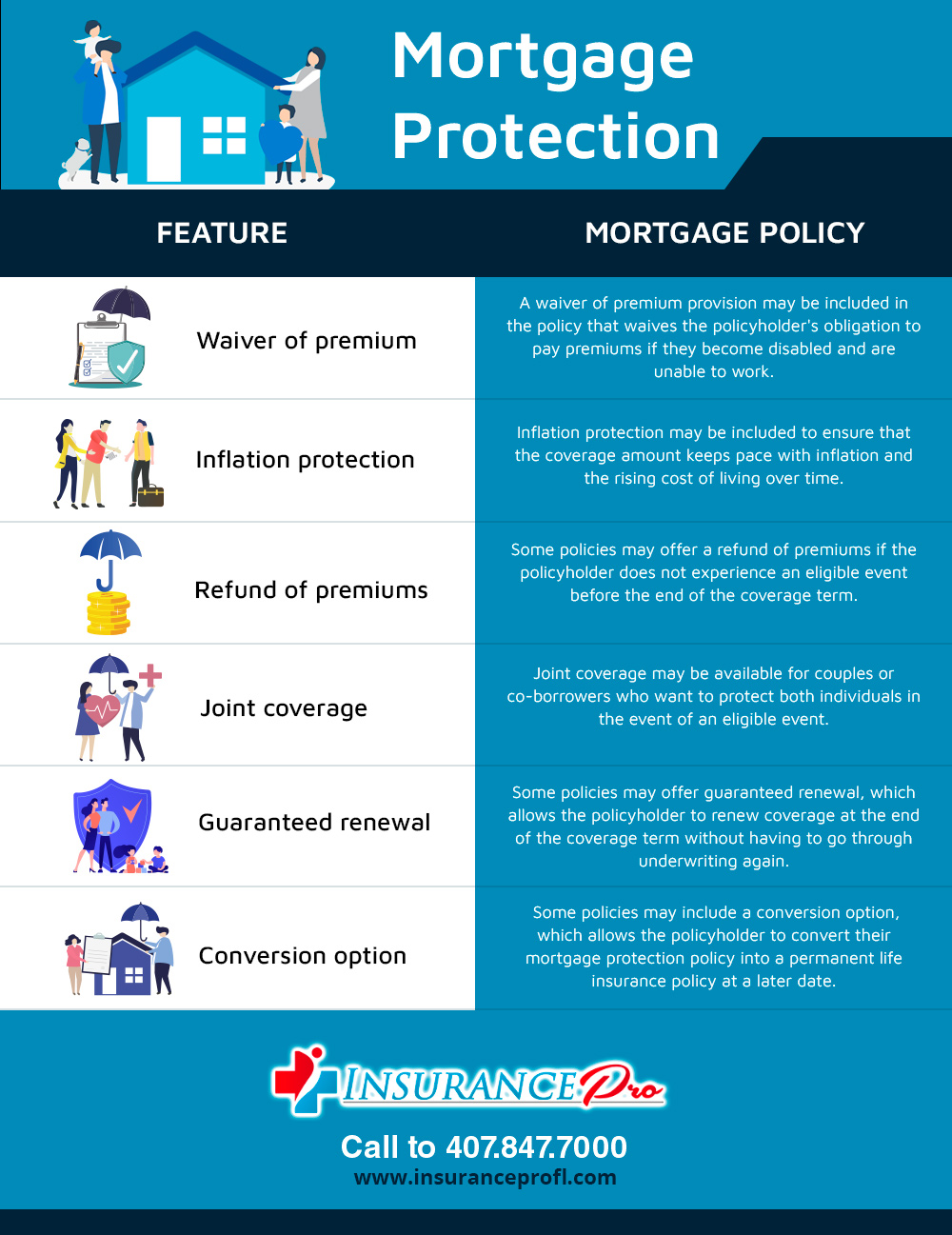

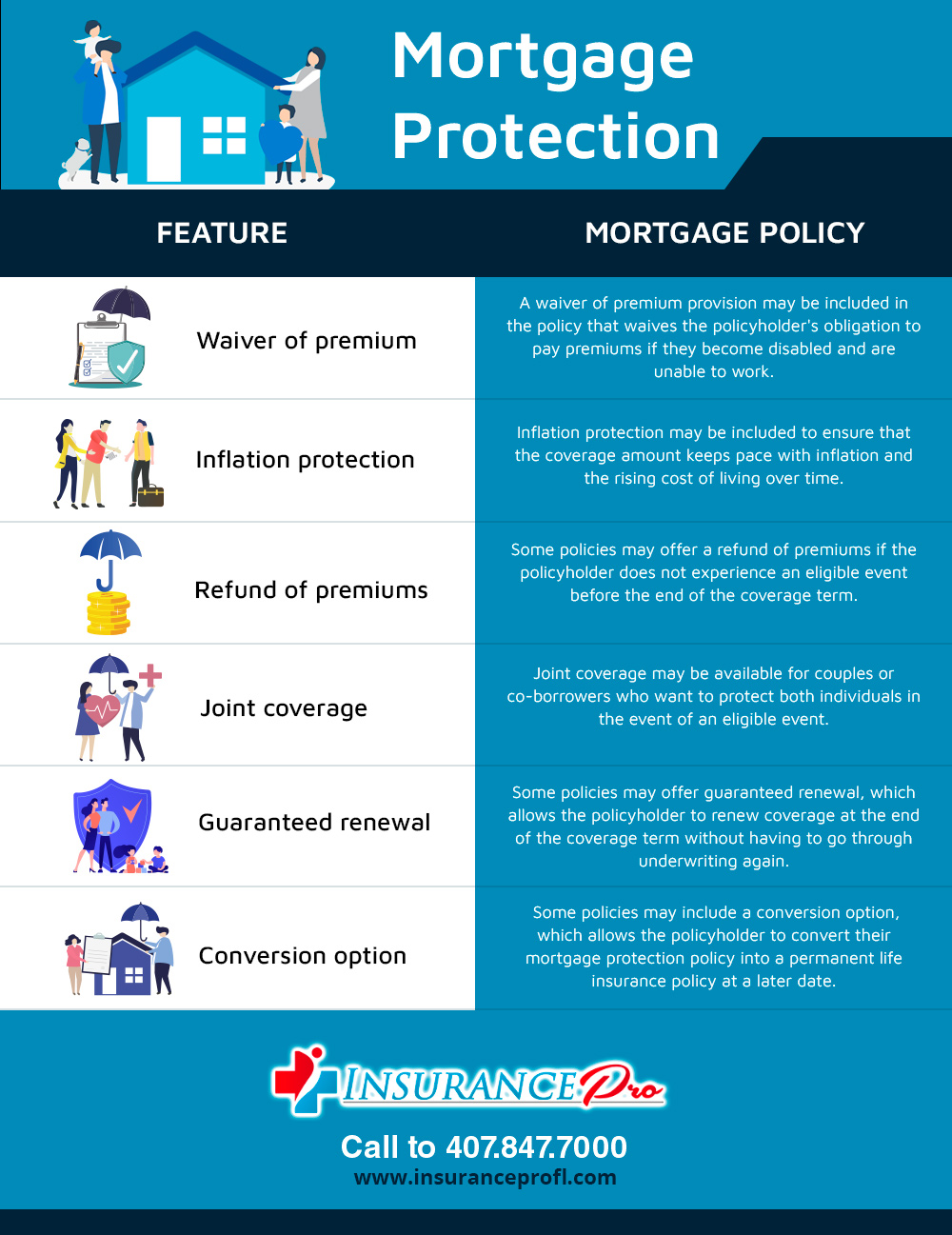

Mortgage life insurance provides near-universal protection with minimal underwriting. There is often no medical exam or blood example needed and can be a valuable insurance plan alternative for any homeowner with major preexisting medical conditions which, would prevent them from acquiring standard life insurance policy. Other advantages include: With a home mortgage life insurance policy policy in place, beneficiaries will not have to stress or question what might take place to the family members home.

With the home loan repaid, the family members will constantly belong to live, provided they can manage the real estate tax and insurance yearly. insurance policy mortgage loan.

There are a few various types of home loan security insurance, these consist of:: as you pay even more off your home loan, the amount that the policy covers reduces according to the outstanding equilibrium of your home loan. It is the most usual and the most affordable kind of home mortgage protection - mortgage cover uk.: the amount guaranteed and the premium you pay continues to be level

This will certainly pay off the mortgage and any remaining equilibrium will certainly most likely to your estate.: if you desire to, you can add severe disease cover to your home loan protection plan. This indicates your home loan will be gotten rid of not only if you die, but additionally if you are diagnosed with a significant ailment that is covered by your policy.

Life And Disability Insurance For Mortgage

Additionally, if there is an equilibrium staying after the mortgage is gotten rid of, this will certainly most likely to your estate. If you transform your home mortgage, there are several things to consider, relying on whether you are covering up or expanding your mortgage, changing, or paying the mortgage off early. If you are covering up your home loan, you require to ensure that your plan satisfies the brand-new value of your mortgage.

Contrast the prices and advantages of both choices (life insurance on a loan). It might be less expensive to keep your initial home loan defense plan and afterwards acquire a 2nd plan for the top-up quantity. Whether you are covering up your mortgage or expanding the term and need to obtain a new policy, you may discover that your premium is higher than the last time you got cover

What Is Mortgage Insurance On A Home

When switching your home loan, you can appoint your home mortgage protection to the new lender. The premium and degree of cover will coincide as before if the amount you obtain, and the regard to your home mortgage does not alter. If you have a plan via your loan provider's team plan, your lending institution will certainly cancel the plan when you switch your mortgage.

There won't be an emergency where a huge costs schedules and no chance to pay it so soon after the fatality of an enjoyed one. You're giving satisfaction for your family! In California, home loan protection insurance policy covers the whole impressive equilibrium of your loan. The survivor benefit is an amount equal to the balance of your home loan at the time of your passing.

Payment Protection Insurance Quote

It's necessary to comprehend that the fatality benefit is given straight to your lender, not your enjoyed ones. This ensures that the remaining financial debt is paid in full which your liked ones are saved the financial stress. Mortgage security insurance coverage can also supply momentary coverage if you end up being disabled for an extensive duration (usually 6 months to a year).

There are lots of benefits to getting a home mortgage defense insurance coverage in The golden state. Some of the top benefits consist of: Ensured approval: Also if you're in bad health and wellness or work in a hazardous profession, there is ensured authorization without any medical tests or lab tests. The same isn't true permanently insurance.

Handicap security: As specified above, some MPI plans make a few home loan repayments if you end up being disabled and can not generate the very same income you were accustomed to. It is necessary to note that MPI, PMI, and MIP are all various kinds of insurance policy. Home loan defense insurance coverage (MPI) is created to settle a home loan in case of your fatality.

Mortgage Debt Insurance

You can even apply online in minutes and have your plan in place within the exact same day. To learn more concerning obtaining MPI protection for your home financing, call Pronto Insurance policy today! Our knowledgeable representatives are here to answer any questions you might have and supply additional assistance.

It is advisable to contrast quotes from various insurance companies to locate the finest price and protection for your demands. MPI provides a number of benefits, such as satisfaction and streamlined credentials processes. It has some constraints. The survivor benefit is straight paid to the loan provider, which limits versatility. In addition, the benefit amount reduces with time, and MPI can be more expensive than common term life insurance policy policies.

Loan Cover Policy

Enter basic details about on your own and your home loan, and we'll compare prices from various insurance firms. We'll likewise show you exactly how much protection you need to shield your home mortgage. Obtain started today and give on your own and your family the peace of mind that comes with knowing you're protected. At The Annuity Specialist, we recognize house owners' core problem: guaranteeing their family members can maintain their home in the event of their death.

The primary advantage right here is clearness and confidence in your decision, knowing you have a plan that fits your demands. As soon as you authorize the plan, we'll manage all the paperwork and arrangement, ensuring a smooth application process. The favorable outcome is the tranquility of mind that features recognizing your family is safeguarded and your home is safe, whatever happens.

Professional Guidance: Guidance from skilled professionals in insurance coverage and annuities. Hassle-Free Setup: We deal with all the paperwork and execution. Cost-Effective Solutions: Finding the most effective coverage at the most affordable feasible cost.: MPI especially covers your mortgage, offering an additional layer of protection.: We function to discover the most cost-efficient services customized to your spending plan.

They can offer details on the protection and advantages that you have. Typically, a healthy and balanced person can anticipate to pay around $50 to $100 monthly for home loan life insurance policy. It's suggested to get a personalized mortgage life insurance coverage quote to obtain a precise quote based on private circumstances.

Table of Contents

Latest Posts

Texas Funeral Insurance

Funeral Life Insurance For Seniors

Aarp Burial Policy

More

Latest Posts

Texas Funeral Insurance

Funeral Life Insurance For Seniors

Aarp Burial Policy